Getting The P3 Accounting Llc To Work

Wiki Article

Our P3 Accounting Llc Statements

Table of ContentsThe Best Guide To P3 Accounting LlcNot known Facts About P3 Accounting LlcThe Buzz on P3 Accounting LlcA Biased View of P3 Accounting LlcThe Best Guide To P3 Accounting LlcMore About P3 Accounting Llc

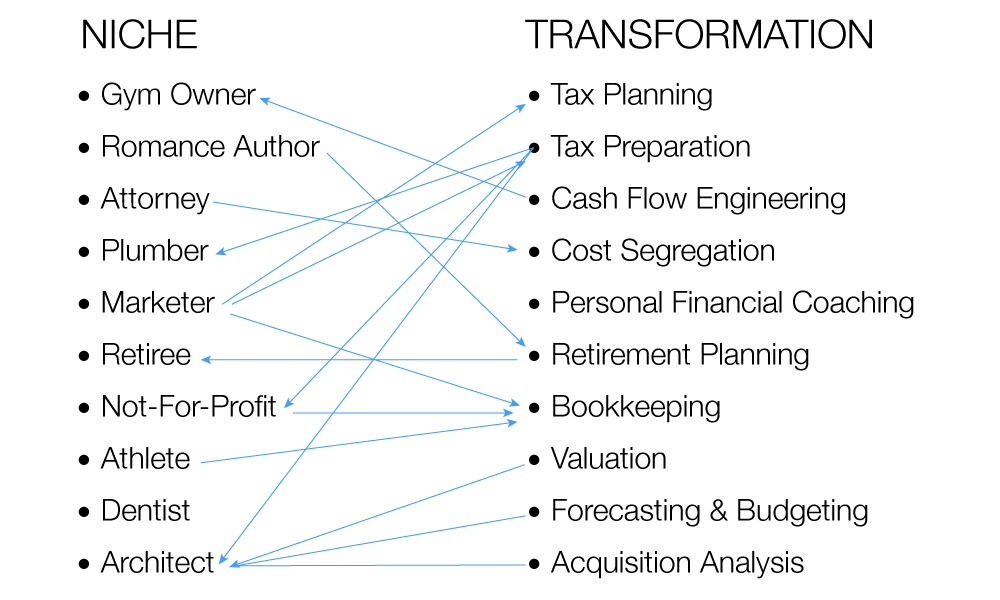

Or, as Merhib put it, "You require to have the books in great order to advise your clients on what they can be performing with their businesses." The majority of firms that provide CAS serve either one or a handful of particular niches and for great factor. "Customers want experts, not generalists," Mc, Curley stated.

However getting this expertise requires time, initiative, and experience. To be an effective advisor, a certified public accountant could require to come to be totally accustomed to an offered field's procedures, threat variables, consumer kinds, KPIs, governing setting, and so forth. CPAs who deal with medical professionals, as an example, require to learn about payment and Medicare, while those that collaborate with restaurants require to learn about food fads, distribution expenses, and state laws concerning tipping.

Things about P3 Accounting Llc

Having a niche can additionally assist companies focus their advertising initiatives and pick the appropriate software. It can additionally aid a company enhance its processes, something ACT Services understood when it picked to specialize. The company began as generalists, remembered Tina Moe, CPA, CGMA, the proprietor and chief executive officer of ACT Solutions."I joked that our clients just had to behave, be certified, and pay our expense." Since they concentrate on three markets, Fuqua said, "we have the ability to standardize and automate and do things faster." Because starting a CAS method is such a complicated task, companies need to completely dedicate to it for it to flourish (see the sidebar "Making Pizza Revenue").

That means dedicating cash, team, and hours to the CAS venture. Ideally, have someone devoted to CAS complete time, Merhib claimed. bookkeeping OKC. Though you may begin having a team member from a different area functioning component time on your CAS effort, that's not sustainable over time, he claimed.

Some Known Details About P3 Accounting Llc

Otherwise, he claimed, they'll have a hard time to succeed at balancing both facets of the role. Lots of sources now exist to assist companies that are starting to provide CAS. Organizations consisting of the AICPA have actually produced products companies can use to discover CAS and provide training programs that cover every little thing from pricing to staffing to how to speak with customers regarding the worth of CAS.After her company took some steps towards CAS by itself, she took a CAS workshop she located very handy. "We were trying to take bits and items of details from various resources to try and produce our very own CAS department, yet it resembled reinventing the wheel. It was extremely taxing," she claimed.

Not known Facts About P3 Accounting Llc

Hermanek and his group were able to significantly boost a client's money flow by obtaining them to adopt automatic accounts receivable software application. By doing so, the client's receivables gone down from an average of 50 days to thirty days. Be certain to provide your CAS team adequate time to train on modern technology, Hermanek said.

You most likely really did not start your organization to procedure economic statements, invest hours investigating tax obligation compliance laws or fret concerning every detail of the deductions on your employees' pay-roll. The "business" side of company can occasionally drain you of the power you desire to route toward your core solutions and items.

Some Known Questions About P3 Accounting Llc.

The solutions you can get from an expert bookkeeping company can be tailored to satisfy your needs and can include basic everyday bookkeeping, tax obligation solutions, auditing, monitoring consulting, scams investigations and can also work as an outsourced chief monetary officer to give monetary oversight for your small company. From the Big 4 (Deloitte, Pricewaterhouse, Coopers, KPMG and Ernst & Youthful) to small-business accountancy firms, the major services supplied include accounting and bookkeeping.The firm can assist you with long-range planning, such as getting property or upgrading your framework. It can likewise aid you figure out how to recover cost and what your cash-flow requirements are. These solutions help you intend your next steps, find out whether you are earning a profit and make choices about your firm's development.

This could be a need of your investors or composed right into the bylaws of your consolidation. https://www.gaiaonline.com/profiles/p3accounting/46510590/. Audit firms conduct audits by checking out not just financial documents, but additionally the processes and controls in location to guarantee records are being correctly kept, plans are being complied with, and your economic methods aid support your business objectives and are the most effective way to do so

All About P3 Accounting Llc

A prominent specialized location, many accountancy companies offer a variety of tax obligation solutions. The company's accountants can aid you determine a brand-new tax obligation code to help ensure your monetary reporting techniques are in compliance with present internal revenue service regulations, determine your business's tax obligation responsibility, and make certain you meet filing demands and target dates.Report this wiki page